Originally published June 24, 2013

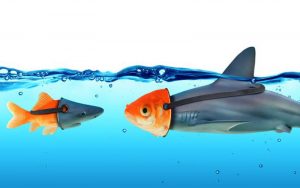

In my last article I spoke about the danger of being too broad and general in the services we offer – the “Jack of all trades, master of none” phenomenon. However, a danger exists at the other end of the spectrum, so it seems appropriate to write at least a short note on the opposite risk: being overly specific in our skills.

This was something that always struck me when I worked as a financial/business analyst at the large company for which I worked prior to starting my firm. In other departments, there were people who were absolute masters of their crafts. Hardworking, intelligent, dedicated, and very knowledgeable. But some of the jobs were so specific that they would have been completely useless in any other industry – sometimes even useless at another company in the very same business!

Obviously someone needed to do those things, otherwise the positions would not have been available – the same as in any other industry. But it does beg the question: do you personally want to be a person (or business owner) whose fate and entire area of expertise are tied to one skill, industry, or company? Especially in a world as fast changing as ours?

It reminds me of an episode of the show 30 Rock in which Liz Lemon (the talented Tina Fey), a TV writer, was afraid her industry was dying in the wake of reality TV shows. She had the following conversation in a dream:

Liz: Who are you?

Woman: Better to ask who we used to be. People whose professions are no longer a thing. Once I was called “Travel Agent”.

Man 1: I was an American auto worker.

Man 2: And I played dynamite saxophone solos in rock and roll songs!

Woman: Come [with us]. We live under the subways with the CEO of Friendster.

What will happen to us when the industry or economy shifts? If our industry goes through a turbulent time, do we have a skill set that transfers to another? If technology automates a process, does our knowledgebase still provide us with security? What will we do when the unexpected happens?

If we build a reasonably (but not overly) broad, flexible, and transferable skill set then we are setting ourselves up for success. If we have decided to become the world’s greatest switchboard operator, laser disk designer, or telegraph technician then we are not. While still focusing our attention on a select few areas of expertise, we all want to make sure that these skills are not overly specific in case the market, our industry, or our personal circumstances shift.

I have kept this in mind as I have structured my accounting firm. While not being “all things to everyone” I have developed expertise in a wide enough range of financial areas so as to be able to properly address the needs of our small business and individual clients.

I could say (as discussed in the previous article) “We do it all! Your taxes, your books, your investments, your home purchase, your lawn, your car, and your dentistry.” And we would end up providing lousy service in all those areas.

Or I could say “If you need someone to advise you on the intricacies of the deprecation of mining equipment as it relates to IRS Code Section XYZ paragraph 2 line 6 with regard to foreign subsidiaries then I’m your guy!”

Instead, my firm provides expert service in a few key areas that are needed by and applicable to the needs of a wide group of clients:

- Individual and business tax preparation and tax savings strategies

- Efficient and cost-saving methods to properly set up and maintain company books and records

- Consulting on ways to most effectively structure and run a small business

Not too broad and not too narrow. The “Goldilocks” approach – not too hot, and not too cold – instead, “just right.” That’s how we do it here, and I consistently recommend to my clients that they do the same.

If you have anything you would like to discuss, please visit me at FraimCPA.com or email me at micahfraim@fraimcpa.com

IRS Circular 230 Notice: To ensure compliance with requirements imposed by the IRS, we inform you that any federal tax advice contained in this communication (including any attachments) is not intended or written to be used, and cannot be used, for the purpose of avoiding penalties under the Internal Revenue Code.