A few years ago, I wrote an article on gold and the fallacy of so-called “safe” investments. One of the major points in that article was that (over the long-term) “low risk” investments can be very expensive because of opportunity cost. Compounding interest is powerful, and the change of a few percentage points of return can make a significant difference over time.

But like anything numbers-related, that doesn’t seem to mean much in the abstract.

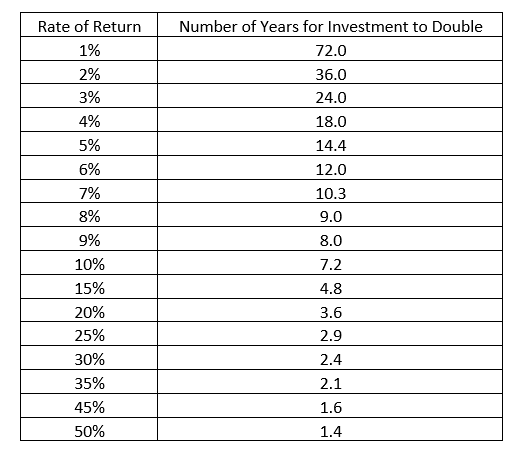

A great back-of-the-envelope calculation – one that can really bring the numbers alive – is called the “Rule of 72”. It goes something like this: if you take the number 72 and divide it by whatever an investment’s rate of return is, the result is the number of years it will take for your investment to double. The chart below illustrates:

Note: this method is not exact. As this Investopedia article shows, it is often 0.2-0.3 years off. But as a rough estimator, it is excellent.

See the difference? If you put all of your money into a “risk free” CD or savings account yielding 2% interest, it will take you 36 years to double that investment. An investment in the stock market (which historically has yielded ~9%) would only take 8 years to double – a full 28 fewer years than the 2% option. And it is not as though the growth stops once that has happened. Your (now substantially larger) investment continues to grow – the results of the previous years’ yields/successes compounding upon themselves.

For example, let’s say that you invest $1,000 a year for 40 years ($40,000 total). At a 2% rate of return you would have about $62,000 – so only $22,000 of gain over that rather lengthy period. At a 9% rate of return, you would have $368,000.

Even if we make the assumption that safe money (CDs, short-term treasury bonds, etc.) will see higher interest rates in the years to come, that does not change the basic premise that over time actual investment rates of return from ownership of stocks or investment real estate will nearly invariably provide a greater long-term return. If today’s 2% CD rates rise to, for example, 4% vs. the long-term equity market’s average return of ~9%, that difference makes a very meaningful impact on the future bottom line value of your assets.

To illustrate in another way, let’s say that a 29-year-old puts aside $5,000 in a retirement account (and trust me – ask any 65-year-old who didn’t start saving at a young age and they will likely tell you they wish that someone had held them down and beaten them until they started). Earning 4% interest, that money doubles in 18 years to $10,000, and in another 18 years to $20,000. So at age 65 that single year’s retirement savings went from $5,000 to $20,000. A quadruple – two doubles. Not too bad, right?

But invested over the same period of time at an average of a 9% return the money doubles every 8 years. So in 36 years that is not two doubles but four. And since that extra two doubles are multiplying on an increasingly larger amount our wise investor has seen his $5,000 grow to $111,000. So which makes the retirement more livable: $20,000 or $111,000? (And that’s just from one year’s retirement savings. Imagine the impact on many, many years of savings.)

Granted, the stock market can have huge swings, volatility, and losses in the short-term. We obviously do not want everything we own to be in the stock market or higher risk investments. As I noted in the gold article: “There are of course reasons and times to have lower risk, lower yield investments. It is important to have a portion of one’s portfolio in liquid, safe, guaranteed instruments (CDs, savings accounts, etc.) to care for cash needs and unexpected occurrences.” In a separate article on Siegel’s Paradox, I also illustrated how important it is to limit your exposure to losses.

In addition, when we talk about the market’s average rate of return of 9% over time, that doesn’t mean a market investment returns 9% every year. Some years it’s 20%, in others it’s zero, and in some years there will be a loss. But none of that really changes the numbers when we’re talking about long-term investments and the average return.

To be clear: I’m not intending this quick discussion to serve as investment planning advice. There are numerous factors to take into consideration when crafting a savings and investment program. I am simply pointing out the mistaken practice of avoiding risk and fearing loss to the point that a person severely impacts their ability to successfully reach their long-term financial goals.

We need to be intelligent about our choices, but we also have to take balanced, calculated risks. Trying desperately to not lose any money will cost us significantly in the end.

Any accounting, business, or tax advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties.