Originally published May 28, 2013

Most of my clients know that I am not a big fan of the home office deduction especially if they are homeowners. While it is certainly tempting to be able to deduct a portion of your otherwise non-deductible personal expenses, in most cases it is simply not worth the cost. I’ll break this into four sections, with the fourth being the least advertised but the most important.

Increase of Audit Risk

The most well-known issue is the fact that taking the home office deduction greatly increases your chances of being audited. People often try to take the deduction in situations where they should not rightfully be doing so and it is a huge red flag to the IRS. The IRS has had great success in disallowing these deductions and continues to look more closely at taxpayers who attempt to take it.

Most of the Expenses are Deductible Elsewhere

If you are a homeowner then your mortgage interest, PMI (usually), and real estate taxes are already deductible on your Schedule A. By claiming the home office deduction you are simply moving a portion of those expenses to Form 8829. The only extra expenses you are allowed are a percentage of your home utilities and some depreciation on your home. As we will highlight later, those deductions often end up being comparatively inconsequential.

High Chance of the Deduction Being Disallowed

The IRS has been effective in disallowing this deduction as many taxpayers are not able to meet the two main tests of:

- Regular and exclusive use

- Principal place of business

Oftentimes the IRS finds that the office space is also used for personal things or that it is not truly the principal place of business. The latter was the case in Xiong v. Commissioner, T.C. Summ. Op. 2007-96. In that case, the IRS disallowed the deduction taken by Texas A&M professor Jin Xiong while he was publishing a book – which was not paid for by the university nor a condition of his employment with the it. The court noted:

“Petitioner has not convinced us that his book writing project is a separate activity rather than an outgrowth of his university teaching and research. While it may be true, as petitioner suggests, that university professors generally are not required to write books, it does not follow that a university professor who writes a book is engaged in a separate business activity. Petitioner’s book is in the same academic discipline as the one petitioner teaches at the university. Petitioner’s contract with Cambridge University Press clearly identifies petitioner as a university professor. Petitioner based his book, at least in part, on teaching notes he had developed over the years, and he used the book in teaching courses at the university. We find that petitioner’s book writing project is so interconnected with his university teaching and research as to not constitute an activity separate from that of his occupation as a university professor.”

The professor admittedly had some missteps:

- The book would later be used as a course book in his classes at Texas A&M, which linked it to his work as a professor

- He took the deduction in years he had no income from the book

- He claimed he could not use his Texas A&M office for writing but offered no evidence to substantiate this

- He did not show that the office was for his employer’s (the publisher) convenience rather than his own

- The list goes on

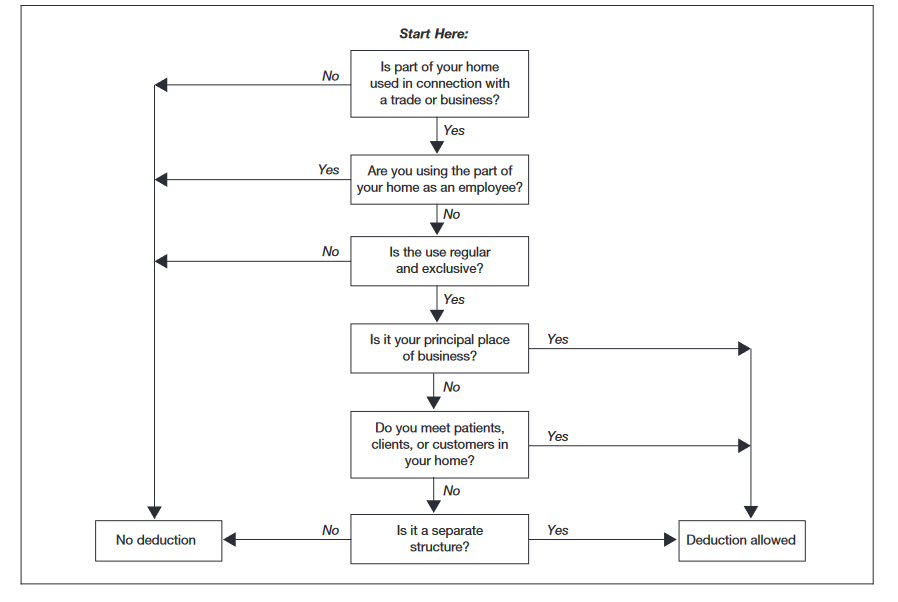

But what it does highlight is that even if the employer is different and the work not inherently related to existing employment, the IRS can easily make the connection. If the self-employment or secondary occupation is very closely related to existing employment where you already have an office, the IRS could reasonably make the link and disallow it. That does not even factor in the other factors that could cause the deduction to be disallowed. The chart below helps walk people through the decision:

Increasing Taxable Income in the Future

Now to the most important (and potentially costly) point. If you are a homeowner, the deduction could make your tax bill skyrocket once you sell your home. There are two key points to look at:

- The possibility of a taxable gain

- Depreciation recapture

1. If your office is a separate structure from the rest of your house, then the gain may very well be taxable (see Pub 587). In those cases you are essentially telling the IRS, “this space is not my home/residence – this is an office used in business.” Why is this important? Because gains of less than $250,000 for single taxpayers or $500,000 for married taxpayers on a home that was a principal residence two of the last five years are tax free. But if you claim that the separate structure was not truly a residence, that portion of the gain is taxable.

To illustrate, let’s say that 15% of your home expenses are related to this separate structure and it is claimed as an office and you have a $100,000 gain on the sale. That means that the gain on that 15% of the home is taxable – a $15,000 increase in taxable income. The majority of the expenses were already deductible on Schedule A. The only benefit you got was temporary depreciation (see below) and 15% of your utility bills every year. That “deduction” just increased your tax bill far more than it ever reduced it.

Please note: this no longer relates to offices that are physically part of your house. Per Pub 523: “If the part of your property used for business or to produce rental income is within your home, such as a room used as a home office for a business, you do not need to allocate gain on the sale of the property between the business part of the property and the part used as a home.”

2. Even if your office is a part of your home, the depreciation has be recognized as an unrecaptured section 1250 gain. Note that choosing not to take the depreciation does not give any benefit. Per the IRS: “If you do not claim depreciation on that part of your home that is a home office, you are still required to reduce the basis of your home for the allowable depreciation of that part of your home that is a home office when reporting the sale of your home.” Essentially, if you could have taken it then IRS acts as though you did when calculating your gain. This can only be avoided by using the simplified home office deduction option announced January 2013, but this is capped at $1,500 and 300 square feet per year.

Bottom line: if you are a renter, are not deterred by the never-ending hassles, and truly meet all of the requirements to take the home office deduction then by all means do so. The risks you take are the chance of audit and the deductions potentially being disallowed. But if you are a homeowner, think long and hard about the true cost of taking this deduction.

As with anything, I always suggest speaking with a tax professional before making any moves. If you have any questions please visit me at FraimCPA.com or email me at micahfraim@fraimcpa.com

IRS Circular 230 Notice: To ensure compliance with requirements imposed by the IRS, we inform you that any federal tax advice contained in this communication (including any attachments) is not intended or written to be used, and cannot be used, for the purpose of avoiding penalties under the Internal Revenue Code.