Q: Is electing a state Pass-Through Entity Tax (PTET) always a smart SALT-cap workaround?

A: Almost always – but not universally. PTET converts state tax into a deductible business expense, cutting federal tax. It backfires only when (1) you already deduct the tax on Schedule A or (2) you have multi-state income and the PTET state uses a subtraction-from-income method, causing double tax.

TL;DR

- Entity-level SALT deduction. PTET shifts state tax from Schedule A to Form 1065/1120S – fully deductible above the $10k cap.

- 90%+ of owners benefit. Most taxpayers don’t itemize or already blow past SALT cap, so PTET is pure federal savings.

- Exception #1: You already itemize, haven’t hit the cap, and PTET would reduce your QBI – small, but a net cost.

- Exception #2: Multi-state filer + “subtraction method” state (e.g., NC, GA, OK). Credit can’t flow to home-state return – double taxation.

- Checklist before electing: confirm state method, review QBI impact, model OSC credits, file entity-level election on time.

When Congress passed the Tax Cuts and Jobs Act (TCJA) in 2017, one of the main changes was capping the amount of state and local tax (SALT) that taxpayers could deduct on Schedule A of their personal returns.

Previously – in theory at least – taxpayers were able to deduct the entirety of state and local taxes that they paid personally. We say “in theory” because with Alternative Minimum Tax (AMT) calculations as well as the Pease Limitation, in practice a large portion of those taxes were still often disallowed. We discussed this at length in our article of potential changes if the TCJA is not extended or revised, if you want a more in-depth discussion on the issue.

Still, the change was significant. You go from no cap to a hard cap of $10,000, whether you’re single or married filing jointly.

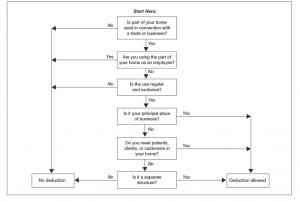

What Is the Pass-Through Entity Tax (PTET)?

As a partial workaround to this, the majority of states with an income tax passed some form of “pass-through entity tax” election (PTET). For profits from partnerships and S-Corps, this election allows you to pay the tax on those profits at the entity level rather than the individual level. And since it is now being paid by the entity, it is now a deductible business expense. On your individual tax return, in most states you receive a tax credit equal to the amount of tax you paid from the business. It’s essentially a convoluted maneuver to get around this SALT cap.

Why the PTET Usually Saves You Money

The tax benefit associated with this can be significant. As an example, if you lived in Virginia and your business made $300,000 in profit, that would generate a Virginia income tax bill of ~$17,000. If you paid that tax on your individual return (assuming you do not itemize on the personal side or already hit the SALT cap), you get no benefit at all. But if you elect the PTET and pay it from the business, that full amount is tax deductible – saving you thousands of dollars in the federal income tax you will pay.

When the PTET Could Hurt You

The question becomes: are there any downsides and are there any instances in which you should not elect the PTET?

The short answer: not usually. For the vast majority of taxpayers eligible for the PTET, they are better off electing it and getting the tax deduction. But there are some unusual circumstances that can make it inadvisable.

What are those situations?

- You are already able to get the full benefit of the state tax paid on the personal side

- You receive income from multiple states and the state you are electing the PTET in uses the subtraction-from-income method rather than the tax credit method

Scenario 1: You’re Already Getting the SALT Deduction Personally

The first situation is pretty unusual, but it could happen. Let’s say:

- You are already itemizing your taxes on Schedule A

- You have not already hit the SALT cap

- The amount of state tax paid from income from your S-Corp will not put you above the SALT cap

In those instances, you would be slightly better off not electing the PTET.

Why?

Because of the 20% Qualified Business Income Deduction (QBI). QBI is calculated on business profit, so by creating a new business expense you are reducing your QBI deduction.

Let’s give an example. Let’s say you give $30k/year to charity – so you’re already itemizing. You paid $5k in state income tax from your W-2 and your business had a $50k profit. Using Virginia again, that $50k will generate ~$3k in state income tax – so still below that $10k SALT cap.

Because of QBI, you are marginally better off paying it personally because you 1) get the deduction either way and 2) the PTET will reduce your QBI by about $600.

However, this is not a circumstance that most people will ever encounter. Only about 9% of taxpayers itemize their deductions to begin with, and those who do are usually high enough earners with high enough property taxes that they’ve already hit the cap.

But still, it is a possibility and it feels irresponsible not to at least mention it.

Scenario 2: You Have Multi-State Income and a “Subtraction Method” State

The second circumstance is also unusual, but is a situation that more taxpayers will run into.

As noted in the outset, the majority of states with PTET legislation have done it via a tax credit mechanism. That means that for whatever tax you pay on the business side you get an equal credit on your personal return. In the majority of states, this is effectively counted as tax paid.

But a handful of states have instead opted for a subtraction-from-income mechanism. Instead of receiving a tax credit, any income tied to the pass-through entity is reduced from your individual return for the purpose of state income taxes. As an example, let’s say your S-Corp had profit of $100k and you paid the PTET tax at the entity level. On your personal return, you would receive a $100k subtraction to your state taxable income.

The end effect is the same as the tax credit state – so long as there are not multiple states at play/you do not have income from multiple states on your return.

If there are multiple states, it can cause significant headaches.

Why?

Because most states have tax credits available for income taxes paid to other states (OSC). But since the subtractions simply reduce the amount of taxable income they do not count as tax paid.

This is a little confusing, so let’s do a few examples.

Examples: What Happens When States Don’t Sync

Example 1: North Carolina Resident with Virginia S-Corp (Works – Mostly)

Let’s say you still have a Virginia S-Corp making $300k in profit, but you’re a resident of North Carolina. Virginia uses the typical tax credit method.

On the business side, you will pay ~$17k in taxes via the PTET. When you file your personal taxes, you will show a PTET credit of $17k on your Virginia tax return. Then on your North Carolina tax return, you will receive a ~$13k-$14k credit for taxes paid to other states – depending on your other sources of income. North Carolina does not allow a 100% credit for taxes paid to other states, so unfortunately a portion of it gets disallowed.

A little convoluted, but it’s still the same basic thing that would happen if you were a resident of a single state. You paid the tax on the business side and then get a credit for it on the personal side. In this specific example of North Carolina you are coping with a portion of the tax paid to another state being disallowed, but that would be the case regardless of if you utilized the PTET or just paid the Virginia tax personally – since, by definition, it is Virginia source income.

Example 2: Virginia Resident with North Carolina S-Corp (Fails – Double Tax)

Now let’s flip the states. You are a Virginia resident but have a North Carolina S-Corp. North Carolina uses the subtraction-from-income method, not the tax credits.

In this scenario, you would pay ~$14k in taxes via the PTET (North Carolina has a slightly lower tax rate than Virginia). Then on your personal North Carolina return, you will show a subtraction of income of $300,000 – ensuring you do not pay the tax a second time.

So far so good.

But here’s the problem: when you file your personal Virginia taxes that subtraction does not get factored in at all. They do not realize that on your entity return you already paid the tax. It just shows that you had no personal taxable income/no personal taxes paid to North Carolina.

So now you end up having to pay the tax on that income a second time.

Since no other state income tax is paid, there is no credit for taxes paid to another state to generate.

That results in double taxation – once at the entity level, and again on your personal return.

As long as you only receive income from your home state, it does not matter; however, this subtraction mechanism is simply not friendly to multi-state taxpayers.

If you do fall into this situation, the PTET ends up costing you more than it saves and is not a mechanism we would recommend.

Conclusion: A Great Tool Unless – You’re the Exception

For most taxpayers, the PTET is a significant tax savings tool with no downsides aside from some additional administrative burden. But if you fall into one of the relatively fringe situations above, it will cost you more than it saves you and should be avoided.

FAQ

What exactly is a PTET?

A state-level election that lets partnerships and S-Corps pay income tax at the entity level. The entity deducts the tax, and owners claim a credit – or subtraction – on their personal returns.

How big is the federal tax savings?

Up to 37% of the state tax paid. Example: $300k Virginia profit → $17k VA tax → $17k federal deduction ≈ $6k federal tax saved.

When should I not elect PTET?

1️⃣ You already deduct the state tax on Schedule A without hitting the $10k SALT cap.

2️⃣ You have multi-state income and your resident state won’t credit the entity-level tax – leading to double taxation.

Which states deny a credit for PTET paid in another state?

Rules change frequently. Some states use a “subtraction-from-income” approach instead of a credit, which can leave you taxed twice when income crosses borders. Always consult your resident state’s latest guidance and run a mock return before electing.

How do I check if I’m at risk of double taxation?

Prepare a mock return: verify that your resident state grants a credit for the entity-level tax. If not, skip the election.

Any accounting, business, or tax advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties.