You dread tax time, right?

You’re never sure if you forgot something, the whole process is confusing or frustrating, your stomach churns from nerves, the paperwork never seems to end, and visions of IRS audits haunt your dreams every night. Well, maybe it’s not that severe but it’s hardly what anyone would call enjoyable.

Except for us.

Call it a disease or a flaw in our personalities, but we love taxes. We love tax preparation, doing tax returns, talking about taxes, developing tax strategies – everything. We’re constantly reading tax articles and reviewing case law. To any of our friends who will tolerate it we’ll even talk about taxes in our spare time. Tax matters are absolutely fascinating to us. What is probably detrimental to our being well-rounded individuals is your gain! Let my obsession work for you!

(The only thing that we find as interesting as taxes is small business and corporate bookkeeping and accounting. But that’s another page on this website.)

The Internal Revenue Code and IRS

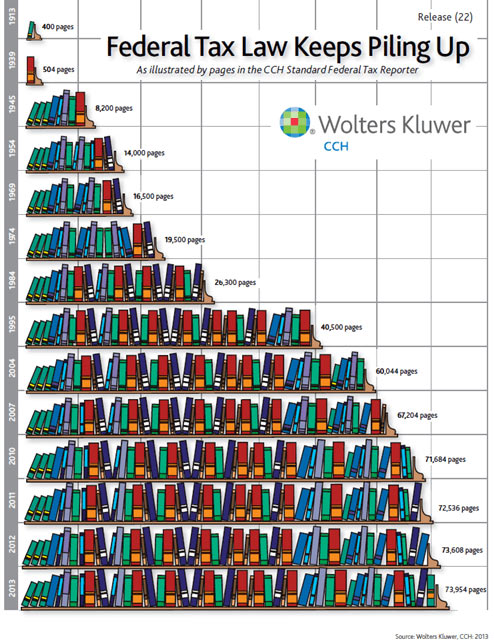

The Internal Revenue Code and IRS opinions are a constantly changing – and expanding – landscape (see below for some amazing and somewhat alarming facts about the Tax Code. You will be likely be astonished. Updates in tax laws, opinion releases, court cases – all of these frequently shift the rules and require updates to the strategies that we, as CPAs and tax experts, use for our clients.

Unfortunately, many preparers are still giving antiquated advice based on now-abolished laws or are doing things that are not recommended based on recent court cases. Our love of everything having to do with taxes keeps us in the loop and means that we are well qualified to handle any type of tax return for you – and equally important, that we can help you implement strategies to ensure both that you pay the least amount of tax possible and avoid difficulties with the IRS.

Tax returns and tax planning for:

- Individuals

- Businesses of all types

- LLCs

- S-Corps

- C-Corps

- Partnerships

- Trusts

- Estates

- Foundations

- Non-profit organizations

Turbo Tax and other online tax programs

Many people nowadays are tempted to use TurboTax and other online tax programs. While these will typically allow you to file your return, that is truly all that they do. They are not going to ensure that you get every deduction that you are due and are not going to question things that would strike us – your personal tax experts – as odd, questionable, or potentially costly to you. These programs are not going to help defend you if the IRS audits.

Even more than that, those programs are not going to help you plan for the tax year. Properly completing a tax return, while a challenge, is only half of the battle. What will you do next year? Is it time to form an LLC or S-Corp? Will your tax bill be large enough to warrant some purchases that would give tax credits or deductions? Should you see if your employer offers an HSA or DCRA? The list of questions is literally endless.

Let us carry the load. This is what we do. This is what we think about. Let our expertise not only benefit you, but take away the stress and uncertainty of the entire situation. Use that extra time to focus on your business or family. Relax in knowing that your taxes are in expert hands.

TAX MADNESS

- The IRS Tax Code is over 73,000 pages long!

- There are almost 1000 different IRS tax forms!

(Originally there was just one – and it was 3 pages long!) - The number of words in Atlas Shrugged is

645,000

The number of words in the Bible is about

700,000

The number of words in the Federal Tax Code

3,700,000

Albert Einstein once said: “The hardest thing in the world to understand is the income tax.” Einstein died in 1955.

Check out the chart here and see if it looks to have gotten simpler since then.