Q: What are the biggest tax changes in the One Big Beautiful Bill Act compared to an expiring TCJA?

A: OBBBA locks several TCJA breaks in place and softens others. QBI stays permanent, the child credit rises to $2,200, the standard deduction is permanently increased, SALT gets a four‑year $40k cap, Pease is repealed, and most business incentives (Section 179, bonus depreciation, QSBS) are extended or expanded. High earners lose 2/37 of deductions in the 37% bracket – nothing like the old Pease 80% haircut.

OBBBA vs. TCJA TL;DR

- QBI deduction made permanent. 20% write‑off survives past 2025.

- Child tax credit jumps to $2,200. Phase‑outs stay at ~$200k/~$400k and are CPI‑indexed.

- SALT cap relief. $40,000 for 2025‑2028, then resets back to $10,000.

- Pease repealed. Top‑bracket deductions save 35¢ vs. 37¢ – no more 80% wipe‑out.

- Section 179 & bonus depreciation. Section 179 increased to $4M; bonus depreciation restored to 100%.

- R&D costs fully expensed again. Domestic R&D costs can be fully expensed in the year incurred. Catch‑up deduction for costs incurred in 2022‑2024.

- Gambling losses limited. Deduction capped at 90% of gambling income – most gamblers now face phantom taxable income.

- AMT threshold permanent. Threshold set at $500k/$1M instead of reverting to pre‑TCJA levels.

- 1099‑NEC/MISC threshold increased. Rises from $600 to $2,000 starting in 2026.

- Tips & overtime deductions. Temporary 2025‑2028 breaks with $25k/$12.5k caps.

▼ Jump to a section

A few months ago we wrote an article talking about the provisions from the Tax Cuts and Jobs Act (TCJA) set to expire at the end of 2025 and what the tax code would look like if Congress did not extend them. You can look back at that article for an in-depth discussion on what the provisions from 2018-2025 were and what was set to happen at the beginning of 2026 had the cuts expired as scheduled.

Congress has now extended – and in some cases expanded on – those tax cuts as part of the “One Big Beautiful Bill Act” (OBBBA). At the same time, it has also removed some credits and instituted new limitations in certain areas that did not exist previously.

So what does the final legislation look like and what are the consequences for you and your business?

Business Taxes

20% Qualified Business Income Deduction (QBI) Made Permanent

Beginning in 2018, pass-through entities (S-Corps, sole proprietorships, partnerships, or LLCs taxed as S-Corps, sole proprietorships, or partnerships) have been eligible for a Qualified Business Income Deduction (QBI) of up to 20% on their profits. So, if your business had a $100,000 profit you would be eligible for an up to $20,000 bonus deduction.

QBI was set to expire at the end of 2025. It has now been made permanent.

In fact, it was partially expanded.

The core 20% deduction stays the same, but there are a few important changes:

- Once your taxable income passes the QBI threshold (~$200k for single taxpayers ~$400k MFJ in 2025, inflation-indexed), the special limits (wage/UBIA test for non-SSTBs and the complete phase-out for SSTBs) now ramp in over a wider “band”: $75k single/$150k MFJ (indexed for inflation), up from $50k/$100k.

- A minimum deduction of $400 has been added for taxpayers earning at least $1,000 from their businesses.

This is a huge win for small business owners. The expiration of QBI was the primary provision we were concerned about and is what would have hit the majority of our clients the hardest. As we’ve noted in the past, for very high earners optimizing for QBI can literally save hundreds of thousands of dollars in taxes.

R&D Costs Can Be Expensed Again

One change that will make a huge difference to a number of small businesses: domestic research and development (R&D) costs can once again be fully expensed in the year they are incurred. Foreign R&D expenses continue to be amortized over 15 years.

Those costs were able to be fully expensed up until 2022. Beginning in that year, the costs had to be amortized over five years. This caused a big mismatch between taxable profit and cashflow for R&D-heavy businesses – because it would show significant phantom income in the years R&D expenses were incurred. Admittedly, they would get the deduction eventually over the full five-year period, but it could be a significant struggle.

Under the OBBBA, this goes away. Domestic R&D expenses incurred in 2025 and after can once again be fully expensed.

In addition, there is partial relief for the costs incurred in 2022-2024 that are still amortizing:

- Eligible small businesses (making less than $31 million in revenue) can amend their 2022-2024 tax returns expensing the R&D costs.

- For small businesses who do not want to amend their returns (and for large corporations who are ineligible to amend), they can elect a catch-up deduction – either taking the full amount in 2025 or splitting it evenly between the 2025 and 2026 tax years.

Need Help This Tax Season?

Take the stress out of tax season. Tell me a little more about your business and

claim your complimentary Tax Strategy Session today!

Bonus Depreciation Made Permanent + Section 179 Expanded

From 2018-2022 you were able to fully depreciate 100% of a qualifying asset’s purchase price in the first year. That has since been going down and was set to be fully eliminated come 2027:

| Tax Year | Bonus Depreciation Percentage |

| 2018–2022 | 100% |

| 2023 | 80% |

| 2024 | 60% |

| 2025 | 40% |

| 2026 | 20% |

| 2027 | 0% |

The OBBBA scrapped that phase‑down schedule. Any qualifying asset acquired and placed in service on or after 01/19/2025 once again qualifies for 100% bonus depreciation – and that rule is now permanent. The 80% (2023) and 60% (2024) rates still apply to earlier purchases, and assets placed in service during the first 18 days of 2025 are stuck with the old 40% rate (for those 2025 assets, Section 179 depreciation is still available).

In addition, Section 179 has been expanded. Beginning in 2025, the maximum deduction has been increased from ~$1.3 million to $2.5 million (indexed for inflation). The phase-out limits have also increased from ~$3.1 million to $4 million.

QSBS (Qualified Small Business Stock) Exclusion Expanded

The qualifications for QSBS and the capital gains exclusion have also been expanded for stock issued after 07/04/2025. Key changes:

- Previously, a business could not have over $50 million in aggregate gross assets. This cap has been increased to $75 million and is indexed for inflation.

- The maximum gain exclusion increased from $10 million to $15 million.

- Previously, stock needed to be held for at least 5 years in order to qualify for the exclusion. For stock issued after 07/04/2025 it is tiered. Stock must be held for at least:

- 3 years for a 50% exclusion

- 4 years for a 75% exclusion

- 5 years for a full 100% exclusion

These changes are helpful for qualifying corporations, but ultimately do not affect the vast majority of small businesses. We noted this in our comprehensive guide on the QSBS, but a C-Corp – even when a QSBS exclusion is anticipated – is not the optimal structure for most small businesses.

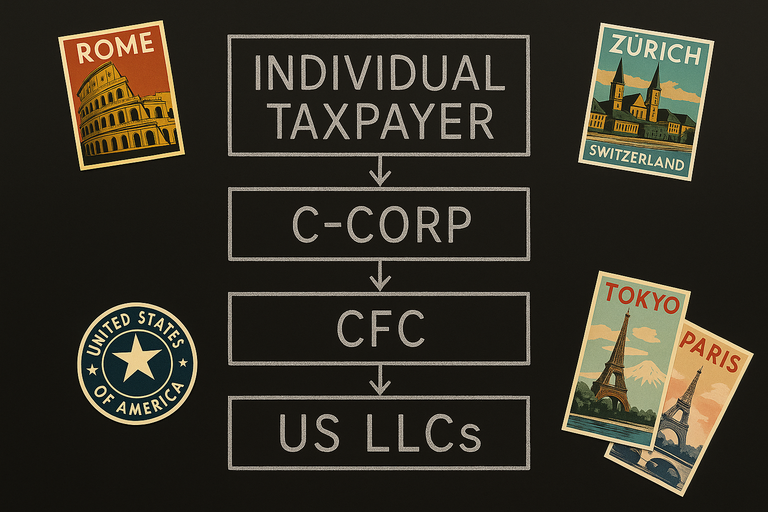

GILTI Renamed and Revised

Global Intangible Low-Taxed Income (GILTI) has been changed to Net CFC Tested Income (NCTI). This is a complex tax structure related to international companies and some expats who live abroad. We wrote an in-depth discussion on this structure and when it makes sense. Some key changes:

- For 2026 and onward, the Section 250 deduction has been changed to a permanent 40% (12.6% tax rate) vs. the scheduled 37.5% deduction (13.125% tax rate).

- The credit on deemed-paid foreign tax credits has been increased from 80% to 90%.

- The 10% Qualified Business Asset Investment (QBAI) carve‑out is gone. Beginning in 2026, all net tested income from a CFC counts toward NCTI, so owning tangible property no longer shelters a slice of profit.

Taken together, these tweaks make NCTI marginally tougher on lightly taxed foreign earnings, but this remains a niche planning tool for multinational owners and a small subset of high earning expats. Most US taxpayers are untouched by the change.

1099-NEC/1099-MISC/1099-K Thresholds Increased

Under the old rules, if you paid a service provider over $600 during the year you were required to issue them a 1099. For the majority of taxpayers this was on a 1099-NEC, but for a few select categories (attorneys, medical providers, etc.) it was still done on a 1099-MISC.

Beginning with the 2026 tax year, that threshold has been increased to $2,000, and that amount has been indexed for inflation.

From a paperwork standpoint, this is a major win. That $600 threshold dates back to 1954 and has never been changed. Had it been indexed for inflation, the threshold would be over $7,000 today.

In addition, the legislation restores the original dual test for Form 1099‑K reporting – more than $20,000 in gross payments and more than 200 transactions during the calendar year. The change is retroactive to 2022, nullifying ARPA’s planned phase‑down (which would have reached a $2,500 / 0‑transaction trigger in 2025). With this change, a platform issues a 1099‑K only when both conditions are met – exceeding one test but not the other no longer creates a filing requirement.

Employer Student Loan Assistance Renewed

The CARES Act rule that lets a company pay or reimburse up to $5,250 a year, tax-free, of an employee’s student loan debt, was scheduled to expire after 2025. The OBBBA makes that provision permanent and indexes the $5,250 limit for inflation starting in 2026.

Individual Taxes

Individual Tax Rates Made Permanent

The TCJA reduced the top individual tax rate from 39.6% to 37%. It also reduced tax brackets across all income levels somewhat as well.

Those tax rates were set to revert to their pre-TCJA levels after 2025. Instead, the existing tax rates have also been made permanent.

Alternative Minimum Tax Threshold (AMT) Levels Made Permanent

The TCJA increased the AMT threshold from $120,700 to $500,000 for single taxpayers and from $160,900 to $1 million for married taxpayers. Those were set to revert back to pre-TCJA levels beginning in 2026.

Those higher thresholds have been made permanent – largely. The $500k/$1 million thresholds had been indexed for inflation, so for the 2025 tax year they were $578k for single filers and $1.156 million for married taxpayers. The OBBBA resets those thresholds back to the original $500k for single filers and $1 million for married taxpayers – and then immediately applies the normal inflation adjustment. In practice, this means that the 2026 threshold will be marginally higher than $500k/$1 million and then will keep rising for inflation after that.

For anything over the exemption threshold, the phase-out rate increases from 25% to 50% beginning in 2026 – although that will not affect the vast majority of taxpayers. As we’d noted previously, only 200,000 taxpayers paid AMT under the TCJA – a decrease of 96%.

SALT Cap Increased – Temporarily

The TCJA limited the number of state and local taxes (SALT) you could deduct on Schedule A at $10,000. This cap was set to expire after 2025 with taxpayers being able to deduct the entirety of their SALT taxes.

The OBBBA has increased this limit for the 2025-2029 tax years, although it did add an income phase-out threshold that did not exist previously. For every dollar your Modified Adjusted Gross Income (MAGI) is above the limit, your SALT deduction will be decreased by 30 cents. Both the cap and threshold increase 1% per year beginning in 2026.

For 2030 and years after, the cap resets to $10,000 and the phase-out threshold goes away.

Here is how that will look for each year:

| Tax Year | SALT Cap | Phase-out Threshold |

| 2025 | $40,000 | $500,000 |

| 2026 | $40,400 | $505,000 |

| 2027 | $40,804 | $510,050 |

| 2028 | $41,212 | $515,151 |

| 2029 | $41,624 | $520,302 |

| 2030+ | $10,000 | N/A |

That SALT cap increase sounds – and is – helpful for the 2025-2029 tax years, but it will make less of an impact than most people are expecting.

Why? Because:

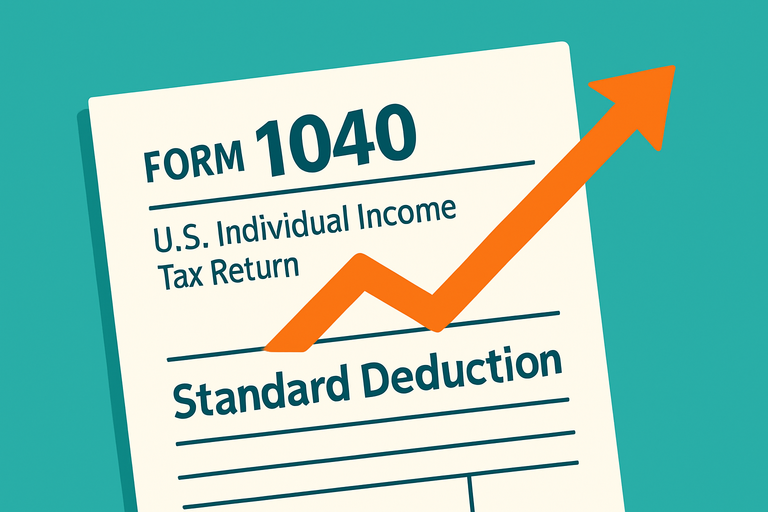

Standard Deduction Increase Made Permanent

The TCJA roughly doubled the standard deduction. The standard deduction was set to revert – adjusted for inflation – back to those pre-2018 levels.

The OBBBA made this increase permanent. And for 2025 they increased the thresholds slightly above even the TCJA levels:

| Filing Status | Pre-TCJA | TCJA | OBBBA |

| Single | $6,350 | $15,000 | $15,750 |

| MFJ | $12,700 | $30,000 | $31,500 |

In addition, those age 65 and older have been enjoying a “bonus” of an additional $2,000 for single filers or $1,600 per spouse for married filers on their standard deduction. From 2025-2028, that will be increased by an additional $6,000 (for a total of $7,600 per senior on a joint return or $8,000 per single senior).

With the increased standard deduction, the number of taxpayers who itemized dropped from around 30% pre-TCJA to 9% post-TCJA. These changes being made permanent will only solidify that trend.

Admittedly, that 9% itemization rate already reflects the strict $10,000 SALT cap. Lifting it will certainly help some high ‑income tax filers, but far fewer taxpayers than the headlines imply will end up clearing the higher itemization threshold.

Major Changes to Charitable Donations

Historically, you have only been able to deduct charitable donations if you itemized your deductions. The exception to this was for the 2020 and 2021 tax years where you were able to deduct up to $300 in charitable donations if you filed single and $600 if you were married filing jointly. A similar deduction is now being made permanent.

Beginning in 2026, taxpayers will be able to deduct up to $1,000 in charitable donations ($2,000 if they are MFJ). This is not indexed for inflation and donations to donor-advised funds do not qualify.

But it’s not all positive. If you do itemize your deductions, for the first time ever there is a “floor” on charitable donations based on your AGI.

This is similar to the 7.5% of AGI threshold that exists for medical expenses. Let’s say your AGI is $100,000. The first $7,500 of medical expenses you have are disallowed and it is only the amount over that limit that can count as an itemized deduction.

Beginning in 2026, the same thing is going to happen for charitable contributions – although the threshold is lower at 0.5% of AGI. Using that same $100,000, the first $500 of donations will be disallowed. That’s not awful, but at certain levels it does start to sting.

C-Corporations now have a threshold of 1% of their AGI – which is perhaps a larger concern for charities looking for funds. A corporation making $10 million will lose/still be taxed on the first $100k of donations they make. That is not inconsequential and hopefully will not decrease charitable giving by companies.

“No Tax on Tips. No Tax on Overtime.”

Two of the provisions of the law that got the most headlines were provisions for “no tax on tips” and “no tax on overtime”. While deductions for tips and overtime did make it into the final legislation, calling them non-taxable is more than a little misleading.

Tips Deduction

Let’s start with tips. The final legislation does allow for a deduction on tips received, but only for the 2025-2028 tax years. After 2028, the deduction goes away entirely. That’s the biggest limitation by a mile.

Other key provisions:

- The deduction is capped at $25,000 per return (a married couple shares the same $25k cap).

- The deduction begins to phase out for taxpayers with MAGI over $150k ($300k if MFJ).

- Tips must be “qualified tips”, which are “voluntary cash or charged tips received from customers or through tip sharing”. They also must be received in occupations that customarily and regularly receive tips (i.e., this needs to be tips from customers in industries where tipping is already customary – employers can’t try to get cute and reclassify their employees’ wages as “tips”).

- Another item that is important to distinguish – at least compared to the headlines – is that this is a tax deduction that will be received at the end of the year when taxpayers file their tax returns. This will not affect individual paychecks.

For a single taxpayer making $150k, the full $25k deduction will save them approximately $6k in federal taxes. That’s not inconsequential at all, but it’s also a far cry from “no tax on tips”. And importantly, this deduction goes away entirely beginning in 2029.

Overtime Deduction

The deduction for overtime functions very similarly to the deduction on tips:

- Only valid for the 2025-2028 tax years.

- Maximum deduction of $12,500 for single filers ($25,000 for married filers).

- The deduction only applies to the “overtime premium” (i.e. the extra halftime portion of time-and-a-half pay). The regular base pay received during overtime hours worked does not receive any deduction.

- The deduction begins to phase out for taxpayers with MAGI over $150k ($300k if MFJ).

- This is a deduction to be claimed at the end of the year, not something that will increase individual paychecks.

For a single filer making $150k, the full $12,500 deduction would save them approximately $3k.

$10,000 Vehicle Loan Interest Deduction

For 2025-2028, you are also able to deduct up to $10,000 in interest on qualified loans on qualified vehicles. The IRS notes that the interest must be paid on a loan that is:

- “originated after December 31, 2024,

- used to purchase a vehicle, the original use of which starts with the taxpayer (used vehicles do not qualify),

- for a personal use vehicle (not for business or commercial use) and

- secured by a lien on the vehicle.”

A qualified vehicle is defined as “a car, minivan, van, SUV, pick-up truck or motorcycle, with a gross vehicle weight rating of less than 14,000 pounds, and that has undergone final assembly in the United States.”

The deduction begins to phase out for single taxpayers with a MAGI over $100,000 and MFJ filers over $200,000.

$1,000 “Baby Deposit” to New Savings Accounts

For babies born between 01/01/2025 and 12/31/2028, $1,000 will be deposited into their “Money Accounts for Growth and Advancement” (MAGA) Accounts. These are new savings accounts that function somewhat similarly to 529 plans, although there are key differences:

- The funds cannot be accessed until the child turns 18 years old.

- Annual contribution limit: Up to $5,000 (inflation-indexed) of after-tax money can be contributed into each child’s account per year.

- Employer match: Up to $2,500 of that $5,000 can come from your employer on a tax-free basis. The $2,500 employer match is a per employee limit, not per child. For example, an employee with 10 children cannot receive $25,000 in employer contributions – the total employer contribution is capped at $2,500 per year.

- The earnings grow tax-free until distribution.

- Between ages 18-24, up to 50% of the account balance can be withdrawn for “qualified purposes”. These include tuition, the costs of job training, starting a small business, or a first-time home purchase. From ages 25-29, the full account balance may be withdrawn for qualified purposes.

- Qualified distributions are taxed at long-term capital gains rates. Non-qualified distributions are taxed as ordinary income and subject to a 10% penalty.

- Age 30 and after, the account balance is fully unrestricted and can be used for any purpose whatsoever. Distributions are taxed at long-term capital gains rates.

Gambling Losses Limited

Historically, gambling losses have been 100% deductible up to the extent of winnings. So if you won $20,000 during a trip to Vegas but lost it all, you were able to take a $20,000 deduction on your tax return to offset that gambling income you received from the W-2G. This calculation – in theory – made it a wash.

Beginning in 2026, gambling losses will now be limited to 90% of your gambling income. This means that gamblers – regardless of how much money they lose – will end up with some amount of phantom income on their tax returns.

This is obviously bad news for gamblers, but in a convoluted way may be a positive thing. In practice gamblers were already getting hit with phantom income, they just didn’t realize it.

How?

There are two main ways:

- Gambling losses are an itemized deduction. In order to take the deduction, you are required to itemize. As we noted previously, only about 9% of taxpayers currently itemize – so most people are having to claim the gambling income but are not getting the corresponding deduction.

- Even if the gambling losses do push you into itemization territory, a portion of it is still phantom income. For example, let’s say you’re married and your non-gambling itemized deductions were $15,000. The standard deduction is $31,500, so you normally don’t itemize. But this year you had $20,000 in gambling income/losses, so you itemize with a total of $35,000. On paper, you’re getting to deduct “all” of your gambling losses, but you aren’t really. The only portion you’re getting any tax benefit from is the amount over the standard deduction – in this case $3,500. In this scenario, you were ending up with $16,500 in phantom income – even though the gambling losses were “100%” deductible.

- It is only a true wash if you were already itemizing, and most people aren’t.

- Income thresholds for tax credits and deductions are almost always based on your Adjusted Gross Income (AGI) or Modified Adjusted Gross Income (MAGI), not your taxable income. The gambling income increases your AGI/MAGI but the gambling losses (even if you do itemize) only reduce your taxable income. So for education credits, the QBI deduction, even the cost of your health insurance under an Obamacare plan, all factor into the gambling income with no regard to the gambling losses.

While this is undoubtedly bad tax news for gamblers, maybe it ends up being somewhat beneficial by removing the often inaccurate “I lost as much as I made so it doesn’t affect my taxes” mindset.

Electric Vehicle and Solar Credits Eliminated

The OBBBA eliminated (or accelerated the sunsets) the vast majority of clean energy credits. A few key ones for individuals:

- The up to $7,500 credit for new EVs and up to $4,000 credit for used EVs had no scheduled expiration date. Both credits have been repealed. Vehicles purchased after 09/30/2025 will no longer qualify.

- The 30% credit for residential clean energy (solar panels, batteries, small wind turbines, etc.) was scheduled to be reduced beginning in 2032 and fully eliminated by 2035. This credit has been eliminated entirely after 12/31/2025.

- The 30% credit (capped at $1,200 annually) for energy-efficient home improvements (windows, doors, HVAC, insulation, etc.) was scheduled to expire after 2032. It has been eliminated entirely for work completed after 12/31/2025.

- The 30% credit (max $1,000) for chargers was scheduled to expire after 2032. It now expires for work completed after 06/30/2026.

Personal Exemptions Removed

Pre-TCJA, you were able to claim a deduction of about $4,000 for each person in your household. These were set to return beginning in 2026, but have now been eliminated permanently.

Child Tax Credit Permanently Increased

The TCJA increased the child tax credit from $1,000 to $2,000 per child. This was set to revert back to $1,000 per child.

The OBBBA permanently increased the child tax credit to $2,200 and indexed it to inflation.

Just as importantly, the OBBBA permanently locks in the higher phase-out thresholds of $200k single and $400k MFJ. Had the TCJA simply expired, these thresholds would have decreased back to $75k and $110k MFJ – which would have cut the number of households claiming the child tax credit roughly in half.

One major change to qualify: both the taxpayer (and the spouse, if MFJ) and the child must now have work-eligible SSNs. Previously, only the child needed a SSN.

Deductible Mortgage Interest Threshold Limited, But PMI Returns

Prior to the TCJA, you were able to deduct interest on mortgages up to $1 million. For mortgages obtained after 12/15/2017, this limit was reduced to $750,000. This was set to revert back to $1 million for mortgages obtained 2026 or later.

The OBBBA made the lower $750k limit permanent.

One partially offsetting change is that private mortgage insurance (PMI) payments may once again be deducted as mortgage interest. This deduction lapsed after the 2021 tax year.

Estate Tax Exemption Increased Permanently

The TCJA roughly doubled the estate tax exemption. In 2017, the exemption was $5.49 million per person and increased to $11.2 million in 2018. It now sits at $13,990,000. It was scheduled to revert back to pre-TCJA levels (adjusted for inflation), with some estimates in the neighborhood of $7 million per individual.

Instead, the estate tax exemption was increased to $15 million per person beginning in 2026 and will be indexed for inflation moving forward. This change has been made permanent.

We noted this previously, but this does not affect the vast majority of taxpayers. In 2017, only 12,700 estate tax returns were filed compared to 8,130 returns in 2022.

The estate tax used to be a much bigger deal and would affect everyday households. In 2001 the estate tax exemption was only $675,000 and over 108,000 estate tax returns were filed.

Itemized Deduction Cap (Pease Limitation) Eliminated

The Pease limitation reduced certain itemized deductions for high-income taxpayers (AGI of $261,500 for single filers and $313,800 for married couples). The way it worked was that for every dollar beyond the threshold, itemized deductions were reduced by three cents. This 3% reduction continued to a maximum reduction of 80% of a taxpayer’s itemized deductions.

This limitation was suspended during the TCJA term but was set to return (adjusted for inflation) in 2026.

The Pease limitation has been eliminated entirely and replaced with a much gentler alternative. Instead of losing up to 80% of their itemized deductions, once your income reaches the 37% bracket, the value of itemized deductions that shelter income within that bracket is trimmed so they save 35 cents of tax per $1 of deduction, not 37 cents.

Crypto Still Not Subject to Wash Sale Rules

Good news for the crypto investors out there: crypto is still not subject to the 30-day wash sale rule that applies to securities. Some versions of the bill included amendments that would have subjected crypto to those same rules, but they did not make it into the final legislation.

Because of this, crypto continues to have a unique advantage when it comes to tax-loss harvesting.

No Revival for Miscellaneous Itemized or Moving Expense Deductions

The OBBBA locks in the TCJA suspensions instead of letting them expire. Your miscellaneous itemized deductions (unreimbursed employee expenses, tax preparation fees, advisory fees, hobby costs, etc.) remain nondeductible. Additionally, the beneficial “above-the-line” moving expense write-off stays limited to active-duty military and certain intelligence community moves.

In short: what vanished in 2018 is gone for good.

Conclusion

Congress didn’t just rubberstamp the TCJA for another decade – it rewrote big chunks of it. Some provisions got sweeter (QBI survives and phases out more gently, bonus depreciation pops back to 100%, R&D expenses are fully deductible again). Others tighten the screws (a 0.5% AGI floor before you can deduct charity, a 35-cent cap on itemized deductions for top bracket filers, the 50% AMT clawback). A few popular green incentives – EV credits, rooftop solar credits, energy-efficient home improvements – drop off a cliff after 2025.

Bottom line: had the TCJA simply expired, your returns would look nothing like what you’re used to today. The OBBBA keeps things “more the same” than they would look otherwise, but it also made important changes – some triggering in 2025 and others in 2026. The window to reposition accordingly starts now. Run the numbers and plan accordingly.

FAQ

When do the OBBBA changes hit my tax return?

Most provisions apply to the 2026 tax year. Two big exceptions begin a year earlier: the $40k SALT cap and the temporary tips & overtime deductions, both effective for 2025 returns.

Is the 20% QBI deduction now permanent?

Yes. The One Big Beautiful Bill Act removes the sunset on IRC §199A, so the 20% deduction continues indefinitely – subject to the same wage/UBIA tests and SSTB phase‑outs.

What happens to the child tax credit after 2025?

The credit rises to $2,200 per child and is indexed for inflation. Income phase‑outs remain at roughly $200k single and $400k married filing jointly.

Does the SALT deduction cap really jump to $40k?

Yes – but only for 2025–2028. Married couples can claim up to $40,000 in state and local taxes (SALT) before the cap snaps back to $10,000.

How does the new Pease replacement work?

Pease is gone. Instead, deductions that offset income inside the 37% bracket save 35¢ per dollar, trimming the benefit much more gently than the old 80% Pease limit.

Any accounting, business, or tax advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties.