Q: Does the 21% corporate tax rate make a C-Corp cheaper than an S-Corp?

A: No. After double taxation and lost pass-through benefits, most owners pay more overall with a C-Corp.

TL;DR

- Corporate tax (21%) plus dividend tax (up to 23.8%) usually exceeds a top-bracket S-Corp rate.

- You lose the 20% QBI deduction and many state PTET credits.

- A C-Corp can beat an S-Corp only in niche cases (long-term reinvestment, QSBS, certain international structures).

Ever since the corporate tax rate dropped from 35% to 21% in 2018, one of the more persistent myths I’ve had to dispel is that C-Corps are the best structure for successful business owners. This is especially popular among online “gurus” pushing business “hacks” that supposedly everyone else missed – cementing their genius status and proving why you should work with them. The pitch will be something along the lines of: “The top individual tax rate is 37%, and the corporate tax rate is 21%. If you have any modicum of success, why on earth wouldn’t you be a C-Corp? Why are you paying the extra 16%?”

The problem is that this strategy ignores a broad range of other critical factors. And once those factors are examined, the C-Corp is usually a bad structure for most businesses.

That is not to say C-Corps are always a bad fit. In fact, we sometimes advise clients to set up a C-Corp specifically for tax savings. But very specific circumstances are required for that structure to make sense, which excludes 99% of taxpayers.

Given the complexity of the topic, we’re going to be breaking this discussion into three separate articles:

- C-Corp vs. S-Corp: Which One Makes Sense for Your Business

- How to Use a C-Corp and S-Corp Together to Reduce Your Tax Bill

- The Hidden Risks of Using Licensing Agreements to Shift Income to a C-Corp

Let’s start with the first one.

C-Corp vs. S-Corp: Which One Makes Sense for Your Business

We’ll consider seven key points in this discussion. For a deeper dive, check out our in-depth video: https://www.youtube.com/watch?v=WyJhCllz7Cc&t

The main issues:

- 37% is the top marginal individual tax rate, not your average or effective tax rate

- The median household income in 2023 was $80,610

- C-Corps are not eligible for the 20% Qualified Business Income Deduction (QBI)

- C-Corps are not eligible for the Pass-Through Entity Tax Election (PTET)

- C-Corps are subject to double taxation. Profits distributed from the C-Corp to shareholders are taxable, in addition to the 21% corporate income tax paid on earnings

- Current C-Corp tax rates are historically low and are likely to increase at some point

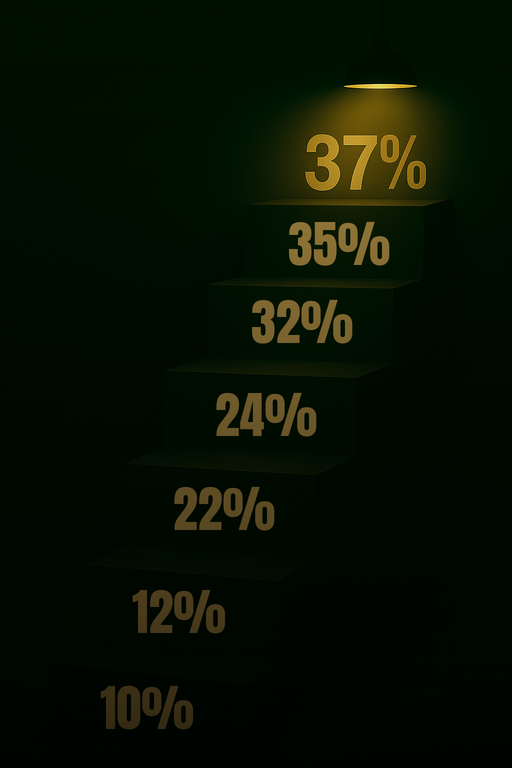

37% Top Tax Rate ≠ Actual Tax Rate

This first bullet on its own is often enough to blow up the guru math. On its face it sounds great. “21% vs. 37% – we’re saving 16%!”. But this ignores that the 37% bracket is only what you’re paying:

- If you even make enough to be in the top tax bracket

- On the last tranche of your income. The other portions were taxed at much lower tax rates

Here are the tax brackets for 2025:

| Tax Rate | Single | Married Filing Jointly | Head of Household | Married Filing Separately |

| 10% | $0 to $11,925 | $0 to $23,850 | $0 to $17,000 | $0 to $11,925 |

| 12% | $11,926 to $48,475 | $23,851 to $96,950 | $17,001 to $64,850 | $11,926 to $48,475 |

| 22% | $48,476 to $103,350 | $96,951 to $206,700 | $64,851 to $103,350 | $48,476 to $103,350 |

| 24% | $103,351 to $197,300 | $206,701 to $394,600 | $103,351 to $197,300 | $103,351 to $197,300 |

| 32% | $197,301 to $250,525 | $394,601 to $501,050 | $197,301 to $250,500 | $197,301 to $250,525 |

| 35% | $250,526 to $626,350 | $501,051 to $751,600 | $250,501 to $626,350 | $250,526 to $375,800 |

| 37% | $626,351 or more | $751,601 or more | $626,351 or more | $375,801 or more |

So if you’re single, dollars 0 through 11,925 are taxed at 10%, dollars 11,926 through 48,475 are taxed at 12%, etc. You don’t even hit the 32% bracket until your taxable income is nearly $200k – and even then, it’s only on the income above that $200k threshold that is being taxed at that rate.

And when you look at that blended rate (what we refer to as the “effective” tax rate), that 21% from the C-Corp starts to look worse and worse.

Without factoring in itemized deductions, child tax credits, QBI, etc., if you were filing single and earning $200k then your effective tax rate would be about 19% federal. If you were married filing jointly it would be closer to 14%.

In both cases, you’re already worse off than with an S-Corp – even before factoring in the loss of QBI, PTET, or double taxation issues we’ll discuss later.

Average Household Income

Now this is the point in the discussion where the gurus will say something along the lines of “well yeah, if you’re only going to earn $200k then this strategy isn’t for you. But we all know you’re going to be making a million dollars with my strategies!”

And I hope they are right. I truly do. Obviously, some people do make that much money. But statistically they’re the exception.

In 2023, the median household income in the US was $80,610. We already saw that the C-Corp doesn’t make sense at $200k if you’re single, so at a minimum you’d need to be earning over triple the average household income in the country.

And if/when you do hit that level, great. We can look at your financials and see to what extent a C-Corp should be incorporated into your strategy. But to set up your business that way based on aspiration (rather than current reality) is a bit foolhardy and will likely cost you significant amounts in taxes.

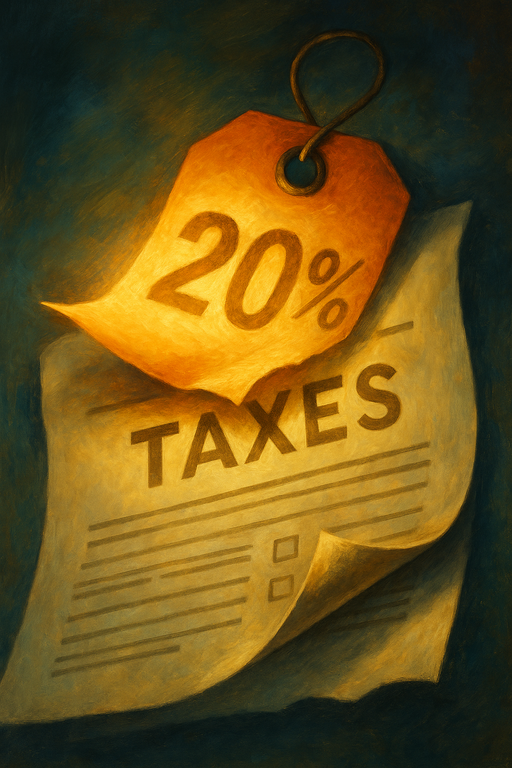

Loss of QBI (Qualified Business Income Deduction)

When the tax code was redone in 2018, Congress created the 20% Qualified Business Income Deduction. This allows for an up to a 20% bonus deduction on whatever your business profits are. So if your business makes a $100,000 profit, you’re allowed an up to $20,000 deduction off the top of that. At higher income levels (~$191k for single filers and ~$383k for married filers) this can be phased out based on total W-2 wages paid from your company, but most taxpayers qualify for the full amount.

But this deduction only applies for pass-through entities: S-Corps, sole proprietorships, partnerships, and LLCs taxed as S-Corps, sole proprietorships, or partnerships.

C-Corps do not qualify.

The loss of that 20% QBI is absolutely massive. It is a major part of the tax planning we do with clients and in some cases we have saved them hundreds of thousands of dollars just by optimizing for QBI.

But C-Corps by definition are not eligible for QBI, which really hurts any calculations to justify using them.

Note: QBI, along with most individual tax provisions from the Tax Cuts and Jobs Act, was originally set to expire at the end of 2025 if not extended. It was made permanent as part of the 2025 “One Big Beautiful Bill Act” (OBBBA). For a full discussion of how the OBBBA compares to the TCJA, see our article comparing the two.

Loss of the Pass-Through Entity Tax Election (PTET)

Another provision of the Tax Cuts and Jobs Act was capping the amount of state and local tax (SALT) that could be deducted on your individual return at $10,000. This upset the majority of states with an income tax, especially those with higher tax rates.

As a partial workaround to this, most of these states enacted some form of “pass-through entity level tax” legislation as a partial workaround.

This legislation allows the tax on S-Corp and partnership profits to be paid at the entity level rather than at the individual level. And because it is now being paid by the business it is a deductible business expense.

As an example, let’s say you live in Virginia and your entity makes a $200,000 profit. That would generate a Virginia tax bill of about $12,000. If you elect the PTET then all of that is a deductible business expense. If you do not and try to deduct it as an itemized deduction on your personal taxes, then the deduction is likely limited if not eliminated entirely.

As C-Corps are not pass-through entities, they are ineligible for the PTET.

Double Taxation

The most obvious factor that is ignored in the 21% vs. 37% rate arbitrage argument is that C-Corps face double taxation. The C-Corp pays the 21% corporate income tax when the profits are earned. And if and when the earnings are eventually distributed to the shareholders, they once again pay tax on those dividends.

Note: I emphasize “when” there, because C-Corp earnings are required to eventually be distributed. We’ll discuss more in-depth in the next article, but the basic crux of how a C-Corp strategy can work is predicated on keeping the profits within the C-Corp for a decade or more. That allows you to invest those additional funds not initially paid in taxes and gives you the potential for a significant time value of money and compounding interest advantage. But – even if you are able to avoid those distributions from a cashflow standpoint – there are compliance issues. Large undistributed earnings from a C-Corp can cause you to run afoul of Personal Holding Company rules and the Accumulated Earnings Tax.

Qualified dividends are taxed anywhere between 0%-20%, with the majority of taxpayers paying between 15%-20%. In addition, single filers earning over $125,000 and married filers earning over $250,000 will pay an additional 3.8% Net Investment Income Tax on those distributions.

Also often forgotten by gurus pitching the C-Corp idea: state income taxes also hit twice as well. This happens once at the corporate level and again when distributed. This makes any C-Corp strategy less viable in states with an income tax.

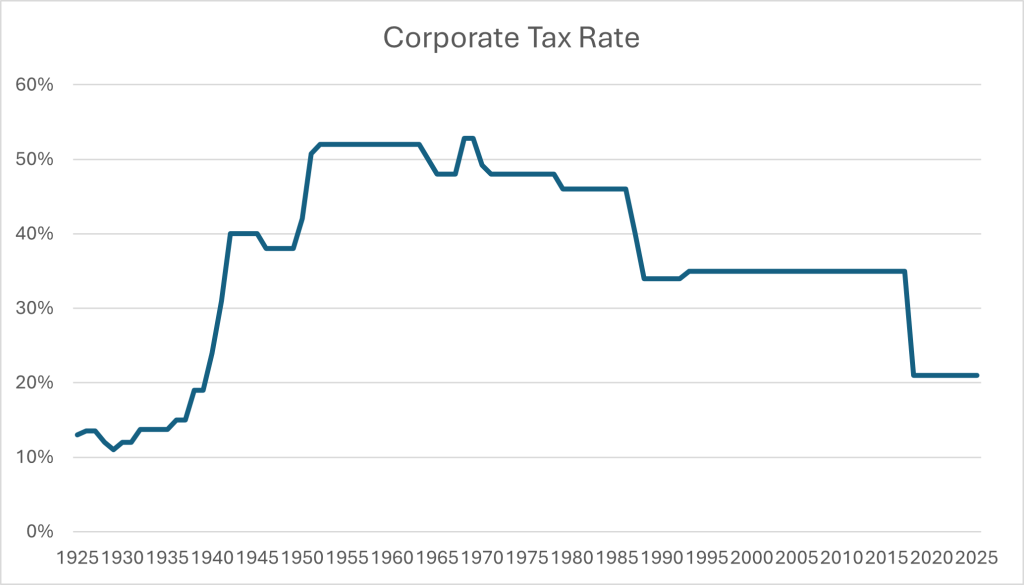

Historically Low Corporate Tax Rates

It’s unknown if corporate tax rates will increase and by how much. But at 21%, they are at historically low levels. Prior to the 2018 changes, the top corporate tax rate was 35% and at various points in the 1950s and 1960s it was over 50%. Look at the chart below for a visualization:

Note: for many of these years, the corporate tax rates were tiered and the last dollar of income was not taxed at the highest rate. For example, from 1993-2017 income from $15 million to $18.33 million was taxed at 38% before going down to 35% on income higher than that. For simplicity, this is visualized as 35% above.

Any rate increases at the corporate level would effectively destroy scenarios where C-Corp taxation would be beneficial to small businesses.

In addition, there have been calls over the years to have long-term capital gains and qualified dividends taxed as ordinary income rather than receiving the current treatment capping them at 20%. This change would also remove basically any scenario where C-Corp would be the most tax-advantaged setup for a small business.

Conclusion

With all of this discussion, it may seem as though I am completely against using C-Corps. This is not the case. There are certain situations where I will actively advise clients to set them up and utilize them within their businesses. But this article should highlight just how niche those situations are. They require a very particular set of circumstances to make sense. But in the very limited circumstances where they do make sense, they can be a powerful tool.

We’ll do a deep dive into that strategy in our next article.

FAQ

Is the 21% corporate tax rate the only tax a C-Corp pays?

No. Profits are taxed at 21% at the corporate level and again when distributed as dividends (up to 23.8%), so the combined rate usually exceeds S-Corp pass-through rates.

When does choosing a C-Corp actually make sense?

A C-Corp pays off mainly when owners will reinvest most profits for five or more years, qualify for QSBS treatment, or need a specific international deferral or captive-insurance structure. For everyday small businesses, an S-Corp is usually more tax-efficient.

Any accounting, business, or tax advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties.